Are you looking for the best payment gateway for your online store website? You’ve come to the right place!

Here, we’ll discuss everything you need to know about choosing a payment gateway and provide you with a list of our top recommendations. So, read on and find the perfect payment gateway for your business!

Difference between a payment gateway and a payment processor?

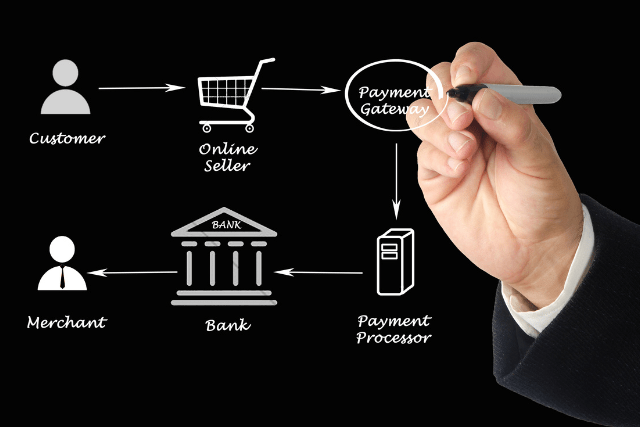

A payment gateway is typically used by merchants who sell products or services online. A merchant will install a payment gateway on their website and then customers can enter their credit card information when they checkout. The payment gateway will then encrypt the credit card information and send it to the payment processor.

A payment processor is a financial institution that processes credit card transactions. Payment processors are typically banks or other financial institutions that have agreements with Visa, Mastercard, or American Express. When a customer makes a purchase with their credit card, the payment processor will verify that the credit card is valid and then approve the transaction.

Payment processors typically charge merchants a fee for each transaction that they process. This fee is typically a percentage of the total transaction amount, plus a flat fee. For example, if a merchant processes $100 worth of sales in a day, they may be charged $2 by their payment processor.

What is a payment gateway?

A payment gateway is a service that allows businesses to accept and process electronic payments through their website or mobile app. Payment gateways facilitate transactions by securely transmitting customer information from the merchant’s website to the payment processor and bank, ensuring that sensitive financial information is protected at all times.

Why are Payment Gateways Important?

1. Payment gateways are important because they provide a secure way for customers to make online payments. They encrypt important information, like credit card numbers, so that it can’t be read by unauthorized people.

2. Payment gateways can also help to improve customer satisfaction by providing a fast and convenient way to make online payments.

3. Payment gateways can help reduce costs by eliminating the need for paper invoices and manual processing of payments. They save time by automating the payment process.

4. Payment gateways can also help protect businesses from chargebacks by ensuring that the customer’s information is accurate and that the funds are available before the transaction is processed.

5. Additionally, payment gateways can help businesses to comply with PCI DSS (Payment Card Industry Data Security Standard) requirements. PCI DSS is a set of security standards that businesses must follow in order to accept credit card payments.

How do you choose the right payment gateway for your business?

When it comes to choosing a Payment Gateway for your online store website, there are several factors you should keep in mind. Some key considerations include the level of security and protection offered by the Payment Gateway, its ease of use and integration with other tools and services, as well as any fees or charges associated with using it.

Business Type

The first step in choosing the right payment gateway for your business is to consider your business type. Are you a B2B or B2C business? If you’re a B2B business, you’ll need a payment gateway that can handle invoicing and recurring payments. If you’re a B2C business, you’ll need a payment gateway that can handle high volumes of transactions.

Sales volume

If you process a high volume of sales, you’ll need a payment gateway that can handle that volume without slowing down your website. You’ll also want to make sure that the payment gateway has fraud protection tools in place to protect your business from chargebacks.

Average transaction size

If you have a high average transaction size, you’ll want to make sure that the payment gateway has no limit on the amount that can be processed per transaction. You’ll also want to make sure that the payment gateway can handle multiple currencies if you sell internationally.

Consider your customer base

If you have customers in multiple countries, you’ll need a payment gateway that can support multiple currencies. You’ll also want to make sure that the payment gateway offers localized support in each of the countries where you have customers.

Development platform

If you have an eCommerce website, you’ll need to choose a payment gateway that is compatible with your development platform. For example, if you have a WordPress website, you’ll need to choose a payment gateway that has a WordPress plugin available. Similarly, if you have a Shopify store, you’ll need to choose a Shopify-compatible payment gateway.

Security needs

When choosing a payment gateway, it’s important to consider your security needs. Make sure that the payment gateway offers SSL encryption for all transactions. You should also verify that the payment gateway is PCI compliant and has been audited by a reputable third-party organization such as VeriSign or McAfee Secure.

Compare pricing plans

Once you’ve considered all of the factors above, it’s time to compare pricing plans from different payment gateways. Make sure to compare both the upfront costs and the ongoing costs of using each payment gateway. Some Payment gateways charge monthly fees while others charge per-transaction fees; find the pricing model that makes the most sense for your business model.

How to set up a payment gateway on your online store website?

Following are the steps for setting up a payment gateway on your website.

Register with a Payment gateway provider.

The first step in setting up a payment gateway on your online store website is to register with a Payment gateway provider, such as Stripe or PayPal. This typically involves creating an account and providing some basic information about your business, such as your name and contact details.

Connect your Payment Gateway to your eCommerce platform.

Once you’ve registered with a Payment gateway provider, you will need to connect that Payment gateway to your eCommerce platform. Depending on the type of eCommerce platform you’re using (such as Shopify or WordPress), this may involve installing a plugin or connecting via an API integration tool provided by the Payment gateway provider.

Configure Payment processing settings on your Payment gateway account.

Once you’ve connected your Payment Gateway to your eCommerce platform, you will need to configure the Payment processing settings on your Payment gateway account. This typically involves setting up billing information and configuring any fraud protection tools or other features that are provided by the Payment gateway provider.

Test your Payment gateway integration with a test order.

Once you have set up the payment processing features on your Payment gateway account, it is important to test that everything is working correctly by placing a test order on your website. This will help ensure that all transactions go through smoothly when real customers start making purchases on your site.

Promote your Payment gateway to your customers.

Finally, once you have set up your Payment gateway and tested it successfully, it is important to promote this Payment gateway to your customers so that they can easily make purchases on your online store website. You may want to include a link to your Payment gateway in the main navigation of your site, or include information about how to use the Payment Gateway on product pages or checkout screens. With the right promotion, you can help ensure that customers are able to easily complete their orders and purchase from your online store with ease.

Tips for optimizing your payment gateway for a better customer experience

Consider the following tips to be implemented on your website so as to optimize the payment gateway. It will provide a hassle-free shopping experience to your customers and ultimately improve customer satisfaction rate.

Make sure that your Payment gateway is fast and easy to use.

One of the key factors in optimizing your Payment gateway for a better customer experience is ensuring that it is quick and simple to use. This means minimizing any steps or processes that may slow down the checkout process, such as requiring customers to create an account before they can make a purchase.

Offer a range of different Payment options.

On your website, offer a variety of Payment options that meet the needs of all types of customers. This may include offering options such as PayPal, credit/debit card payments, Apple Pay or other mobile payment solutions, as well as alternative Payment methods such as eCheck or bank transfers.

Use fraud protection tools to minimize Payment errors and chargebacks.

Minimize payment errors and potential chargebacks due to fraudulent activity. To achieve this, you may want to consider using fraud protection tools such as address verification services, card security codes, or automated approval or pending systems that help prevent potentially fraudulent orders from going through.

Make sure your Payment gateway integrates seamlessly with other parts of your business operations.

It is also important to ensure that it integrates smoothly with other aspects of your business operations. For example, if you use a shipping management platform or CRM system, it may be helpful to look for Payment gateway providers that can integrate seamlessly with these systems, allowing you to streamline your checkout and order fulfillment processes.

Provide clear and consistent Payment instructions on your website.

Finally, in order to optimize your Payment gateway for a better customer experience, it is important to provide clear and consistent Payment instructions on your website. This may involve clearly explaining what Payment options are available at different stages of the checkout process, highlighting any potential fees associated with specific Payment methods, or including information about accepted Payment methods on product pages or shopping cart screens. With the right Payment instructions, you can help ensure a smooth and seamless customer experience when they make purchases on your online store website.

Common problems with payment gateways

1. One of the main problems with payment gateways is that they can sometimes be difficult to integrate or set up, which makes them frustrating and cumbersome for many businesses.

2. Another common issue with payment gateways is that they may not offer a wide range of Payment options, or support Payment methods that are commonly used by your customers.

3. In some cases, payment gateways may also experience issues with fraud protection or security, leading to potential Payment errors or chargebacks.

How to solve these problems?

To address these problems and ensure a smooth and seamless customer experience when using your payment gateway, it is important to take the time to carefully evaluate different Payment gateway providers and choose one that offers fast and easy integration, a wide range of Payment options, effective fraud protection tools, and seamless integration with other systems in your business operations.

Additionally, you should also work to provide clear and consistent Payment instructions on your website that make it easy for customers to understand how to complete payments through your payment gateway successfully. With the right Payment gateway provider and Payment instructions, you can help ensure a smooth and hassle-free experience for all of your customers when making purchases on your online store website.

Best payment gateway providers for online sellers

There are a number of different Payment gateway providers that are well-suited for online sellers.

1. PayPal

PayPal is one of the most popular payment gateway providers and is used by millions of online sellers. The company offers a variety of features, including the ability to accept credit and debit cards, bank transfers, and PayPal payments. PayPal also offers seller protection, which can help to protect you from fraudulent chargebacks.

2. Stripe

Stripe is another popular payment gateway provider that offers a variety of features for online sellers. The company offers support for credit and debit cards, bank transfers, and mobile payments. Stripe also offers fraud prevention tools and chargeback protection.

3. Amazon Payments

Amazon Payments is a payment gateway provider that is owned by Amazon.com. The company offers a variety of features for online sellers, including the ability to accept credit and debit cards, bank transfers, and Amazon Payments. Amazon Payments also offers seller protection against fraud and chargebacks.

4. Authorize.Net

Authorize.Net is a payment gateway provider that offers a variety of features for online sellers. The company offers support for credit and debit cards, bank transfers, and eCheck payments. Authorize.Net also offers fraud prevention tools and chargeback protection.

5. 2Checkout

2Checkout is a payment gateway provider that offers a variety of features for online sellers. The company offers support for credit and debit cards, bank transfers, and PayPal payments. 2Checkout also offers fraud prevention tools and chargeback protection

If you want to find the best payment gateway provider for your online store website, we suggest you look at one of the other providers listed above. They are some of the best choices you have right now.