Amazon has emerged as a game-changer in the world of e-commerce, offering a vast platform for entrepreneurs to showcase and sell their products to a global audience.

With millions of sellers operating on Amazon’s platform, it’s crucial to navigate the intricacies of selling, including understanding Goods and Services Tax (GST) requirements.

Table of Contents

Key Takeaways

- Strategic Alignment: Understand the symbiotic relationship between Amazon sales and GST to optimize profits effectively.

- Compliance is Key: GST registration is mandatory for sellers with substantial turnover, ensuring adherence to tax regulations.

- Profit Dynamics: While Amazon’s platform offers global exposure, consider the implications of GST on pricing and profit margins.

- Expert Consultation: Seek professional advice to navigate the complexities of Amazon selling and GST for successful e-commerce ventures.

Introduction to Amazon Sellers and GST

For aspiring entrepreneurs and existing Amazon sellers, understanding the ins and outs of the Goods and Services Tax (GST) is crucial. With the rapid growth of e-commerce, it’s essential to stay compliant with tax regulations and ensure smooth operations for your Amazon business.

Overview of GST and its relevance for Amazon sellers

GST is a consumption-based tax that replaced multiple indirect taxes in India. It applies to the supply of goods and services across the country. If your annual turnover as an Amazon seller exceeds the government-set threshold, you must register for GST.

The relevance of GST for Amazon sellers lies in its impact on pricing, compliance, and eligibility for tax credits. Understanding GST will help you determine the correct tax rates to apply to your products, ensuring your prices are competitive and compliant with regulations.

The importance of understanding GST for Amazon sellers

Comprehending GST is essential for Amazon sellers due to several reasons:

- Legal Compliance: Registering for GST and filing regular returns is legally required. Non-compliance can lead to penalties and disruptions in your business operations.

- Pricing Accuracy: Understanding the applicable tax rates ensures you price your products correctly, avoiding undercharging or overcharging customers.

- Tax Credits: By registering for GST, you can claim input tax credits on the GST paid on your business expenses. This can help reduce your overall tax liability.

- Competitive Advantage: GST compliance enhances your credibility as a seller, attracting more customers who prefer purchasing from registered businesses.

In conclusion, gaining a thorough understanding of GST is vital for Amazon sellers to ensure legal compliance, accurate pricing, eligibility for tax credits, and a competitive edge in the e-commerce market.

Basics of GST for Amazon Sellers

What is GST, and how does it work?

For Amazon sellers in India, understanding the basics of Goods and Services Tax (GST) is essential. GST is a comprehensive indirect tax levied on the supply of goods and services in India. It has replaced indirect taxes like VAT, excise duty, and service tax.

Under the GST system, sellers are required to collect GST from their customers and remit it to the government. They can also claim input tax credits on their purchases, reducing their overall tax liability. The GST system is designed to streamline the taxation process, eliminate cascading effects, and promote ease of doing business.

Learn More: How to sell on Amazon.

GST registration requirements for Amazon sellers

If your annual turnover as an Amazon seller exceeds the government-set threshold limit, you must register for GST. The threshold limit varies for different states in India. It is important to note that even if your turnover is below the threshold, you can voluntarily register for GST to avail yourself of input tax credit benefits.

To register for GST, you must provide documents such as a PAN card, Aadhaar card, bank account details, and proof of business address. The registration process can be done online through the GST portal.

GST rates and classifications for different products

GST rates vary depending on the type of product or service being supplied. The government has classified goods and services into different tax slabs – 0%, 5%, 12%, 18%, and 28%. It is important for Amazon sellers to correctly classify their products under the appropriate tax slab to ensure compliance with GST regulations.

To determine the correct classification, sellers can refer to the Harmonized System of Nomenclature (HSN) codes provided by the government. These codes help in identifying the product category and applicable GST rate.

Understanding the basics of GST is crucial for Amazon sellers in India. By complying with GST regulations, sellers can ensure smooth operations, avail of input tax credits, and contribute to the growth of the Indian economy.

Responsibilities of Amazon Sellers under GST

Collecting and remitting GST on sales

Amazon sellers in India are required to collect Goods and Services Tax (GST) on their sales. The rate of GST varies depending on the category of products being sold. It is important for sellers to understand the applicable GST rates and ensure that they collect and remit the correct amount of tax to the government.

Filing GST returns and maintaining proper records

Amazon sellers are also responsible for filing regular GST returns with the tax authorities. This involves reporting their sales, purchases, and tax payments. It is crucial for sellers to maintain accurate records of their transactions and keep track of all relevant invoices and receipts.

Input tax credit and its significance for Amazon sellers

One of the key benefits of being a registered GST seller on Amazon is the ability to claim input tax credit (ITC). The input tax credit allows sellers to offset the GST they have paid on their purchases against the GST they have collected on their sales. This helps reduce the overall tax liability and can result in significant cost savings for sellers.

By properly understanding and fulfilling their responsibilities under GST, Amazon sellers can ensure compliance with the law and avoid any penalties or legal issues. It is advisable for sellers to seek professional advice or consult with a tax expert to ensure they are meeting all their obligations under GST.

Please note that this article provides general information only and should not be considered legal or financial advice.

Threshold Limits and Exemptions for Amazon Sellers

GST threshold limits for small-scale Amazon sellers

Understanding the Goods and Services Tax (GST) requirements for Amazon sellers is crucial to ensure compliance with tax regulations. The GST threshold for small-scale Amazon sellers varies depending on the country in which they operate.

In the United States, for example, sellers must register for GST if their annual turnover exceeds $20,000. However, it is essential to note that these thresholds may change over time, so staying updated with the latest regulations is advisable.

Exemptions and concessions available for Amazon sellers

While GST registration is mandatory for many Amazon sellers, certain exemptions and concessions are available. For instance, small businesses with a turnover below the threshold limit may be exempt from GST registration.

Some countries offer concessions or reduced rates for specific goods or services. It is important for Amazon sellers to research and understand the exemptions and concessions applicable to their business to ensure compliance while maximizing their benefits.

Amazon sellers can avoid penalties and legal complications by familiarizing themselves with the GST requirements and exemptions. Sellers should consult with tax professionals or seek guidance from relevant government authorities to ensure they meet all necessary obligations.

Overall, staying informed about GST regulations and taking proactive steps to comply with them will contribute to a smooth and successful selling experience on Amazon.

Impact of GST on Amazon Sellers

Changes in pricing and profitability due to GST

As an Amazon seller, it is important to understand the impact of the Goods and Services Tax (GST) on your business. GST is a comprehensive indirect tax that has replaced multiple taxes in India. Here are some key changes that you need to be aware of:

- Increased costs: With the implementation of GST, sellers now have to pay taxes on their sales. This can lead to increased costs, which may affect pricing and profitability. It is crucial to factor in these additional expenses when setting product prices.

- Input tax credit: One of the benefits of GST is the availability of input tax credit. This means sellers can claim credit for the taxes paid on their purchases. You can reduce your overall tax liability and improve profitability by using an input tax credit.

Compliance challenges and solutions for Amazon sellers

Complying with GST regulations can be challenging for Amazon sellers, especially if you are new to the tax system. Here are some common compliance challenges and their solutions:

- Registration: Sellers must register under GST if their annual turnover exceeds the threshold limit. Register and obtain a GSTIN (Goods and Services Tax Identification Number) to avoid penalties.

- Tax calculation and filing: Calculating taxes correctly and filing regular returns can be complex. Consider using accounting software or hiring a tax professional to ensure accurate calculations and timely filings.

- E-commerce operator compliance: Amazon is considered an e-commerce operator under GST regulations. As a seller, it is important to understand your responsibilities and ensure compliance with the rules set by the platform.

By understanding the impact of GST on your business and addressing compliance challenges, you can navigate the taxation system effectively and continue to thrive as an Amazon seller.

GST Compliance Tools and Assistance for Amazon Sellers

Overview of GST software and tools for Amazon sellers

For Amazon sellers operating in countries where the Goods and Services Tax (GST) is applicable, it is crucial to understand and comply with the tax regulations. Fortunately, Amazon provides various tools and software to assist sellers in managing their GST obligations.

One such tool is the GST calculation service, which automatically calculates the GST on each seller’s sale. This ensures accurate tax calculations and reduces the risk of errors. Additionally, Amazon provides access to GST reports that summarize the seller’s taxable transactions, making it easier to file GST returns.

Amazon offers integration with third-party GST software providers to simplify the compliance process further. These software solutions seamlessly help sellers manage their GST registration, invoicing, and reporting requirements.

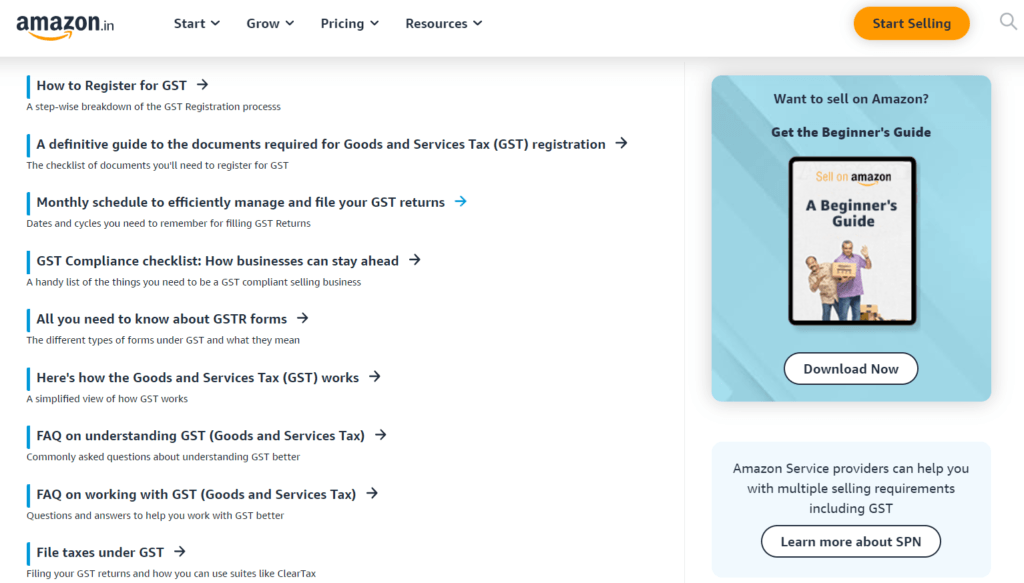

Support and resources available from Amazon for GST compliance

Amazon understands that navigating GST compliance can be challenging for sellers. Amazon provides various resources and assistance to support them in meeting their tax obligations.

First, sellers can access educational materials like webinars, guides, and FAQs explaining GST compliance basics. These resources help sellers understand their responsibilities and stay updated on any changes to the tax regulations.

Additionally, Amazon offers seller support services dedicated to assisting with GST-related queries. Sellers can contact these support teams for guidance on registration, reporting, or any other GST-related issues they may encounter.

By leveraging these tools, software solutions, and support services provided by Amazon, sellers can ensure they remain compliant with GST regulations while focusing on growing their business on the platform.

International Selling and GST for Amazon Sellers

GST implications for Amazon sellers engaged in international selling

Selling products internationally on Amazon can be a lucrative venture for many sellers. However, it is crucial to understand the Goods and Services Tax (GST) implications when engaging in cross-border transactions.

When selling internationally, Amazon sellers need to consider the GST requirements of both their home country and the countries they are selling to. Each country has its tax laws and regulations; failure to comply with them can result in penalties and legal issues.

It is important for Amazon sellers to determine whether they need to register for GST in the countries they are selling to. Some countries have a threshold for registration, while others require registration regardless of sales volume. Sellers should consult with tax professionals or local authorities to ensure compliance with GST regulations.

Import/export duties and GST for cross-border transactions

In addition to GST, Amazon sellers engaged in international selling must be aware of import/export duties. The customs authorities are the ones who impose these duties, which are distinct from GST. Import/export duties vary from country to country and are based on factors such as the type of product, its value, and the country of origin.

When calculating the total cost of international selling, Amazon sellers should consider both GST and import/export duties. Failure to account for these costs can lead to unexpected expenses and impact profitability.

To navigate the complexities of international selling and GST, Amazon sellers should seek professional advice, stay updated on tax regulations, and maintain accurate records of their transactions. By understanding and complying with GST requirements, sellers can expand their business globally while avoiding potential pitfalls.

Common Mistakes to Avoid for Amazon Sellers

For aspiring Amazon sellers, navigating the Goods and Services Tax (GST) world can be daunting. However, understanding and complying with GST regulations is crucial for a successful and legal business operation. Here are some common mistakes made by Amazon sellers regarding GST compliance, as well as tips for avoiding penalties and non-compliance issues.

Common GST compliance mistakes made by Amazon sellers

- Incorrect registration: Failing to register for GST when required can lead to penalties and legal issues. It’s important to understand the threshold for GST registration in your country and register accordingly.

- Inaccurate product classification: Misclassifying products can result in incorrect tax calculations and non-compliance. Take the time to classify your products based on the applicable GST rates.

- Incomplete or incorrect invoices: Invoices are essential for GST compliance. Ensure that your invoices contain all the required information, including your GST registration number, customer details, and accurate tax calculations.

Tips for avoiding penalties and non-compliance issues

- Educate yourself: Familiarize yourself with the GST regulations in your country and stay updated on any changes or updates.

- Maintain accurate records: Keep detailed records of your sales, purchases, and expenses to ensure accurate GST calculations and easy auditing.

- Seek professional help: Consult with a tax professional or accountant specialising in GST compliance for e-commerce businesses. They can provide valuable guidance and ensure you meet all the requirements.

By avoiding these common mistakes and following these tips, Amazon sellers can navigate the complexities of GST compliance more effectively, ensuring a smooth and legally compliant business operation.

Conclusion

To Wrap up, staying updated on GST regulations is crucial for Amazon sellers to ensure compliance and avoid legal issues. By understanding the GST requirements and implementing the necessary measures, sellers can streamline their operations and maintain a good reputation on the platform.

Importance of staying updated on GST regulations for Amazon sellers

- Compliance: Recognizing and adhering to GST regulations is essential to avoid penalties and legal consequences. Amazon sellers must stay updated on any changes or updates in the GST laws to ensure they operate within the legal framework.

- Accounting and Taxation: Understanding GST regulations helps sellers manage their accounting and taxation processes efficiently. By correctly calculating and remitting GST, sellers can avoid financial discrepancies and maintain accurate records for tax purposes.

- Customer Trust: Complying with GST regulations demonstrates professionalism and builds customer trust. When customers see that a seller is transparent and follows all legal requirements, they are more likely to trust the brand and confidently make purchases.

- Competitive Advantage: Staying updated on GST regulations gives sellers a competitive edge. By ensuring compliance, sellers can differentiate themselves from non-compliant competitors, attract more customers, and increase sales.

- Avoiding Legal Issues: Non-compliance with GST regulations can lead to legal issues, including fines, penalties, or even suspension from selling on Amazon. Sellers can mitigate these risks and protect their businesses by staying informed about the latest GST requirements.

It is crucial for sellers to regularly educate themselves on the latest GST updates and seek professional advice if needed.

Frequently Asked Questions

1. Who is the number 1 Amazon seller?

Currently, the top Amazon seller is Amazon itself, the e-commerce giant that directly markets and sells a diverse range of products to consumers across the globe.

2. Who uses Amazon the most?

Amazon’s versatile platform caters to a wide demographic, including individuals, small businesses, and large corporations, establishing itself as a global marketplace with a universal customer base.

3. Who is the biggest seller in the world?

While Amazon is the largest global online retailer, numerous major sellers populate the platform. Recognizable names like Apple, Samsung, and Nike are prominent figures in this category.

4. What is a 3rd party seller?

A 3rd party seller on Amazon refers to an independent individual or business entity that utilizes the platform to sell products. These sellers operate independently, managing inventory, pricing, and customer interactions.

5. Is selling on Amazon profitable in India?

The profitability of selling on Amazon in India hinges on several factors, including product selection, pricing strategies, competition, and effective marketing techniques. Given the burgeoning e-commerce market in the country, there is substantial potential for profitability.

6. Is GST required to sell on Amazon?

GST registration is obligatory for all sellers, including those on Amazon, provided their annual turnover surpasses the predefined threshold. This adherence to GST norms ensures tax compliance in line with India’s tax regulations.

7. Who pays GST on Amazon?

Sellers are responsible for the payment of GST on Amazon transactions. They collect GST from buyers during sales and subsequently remit the collected amount to the government.

8. Is GST registration free?

No, GST registration involves associated costs. The expense varies based on the type of business and the state of operation. It’s advisable to consult tax professionals or refer to the official GST portal for accurate fee details.

9. What items are tax-free in India?

Essential commodities like fresh produce, milk, and basic food items are often exempt from GST in India. However, the official GST rates and exemptions list should be consulted for precise information.

10. What is the limit of GST on Amazon?

There is no fixed GST limit on Amazon. GST rates fluctuate based on the category of the product. Necessities might attract lower GST rates compared to luxury goods.

11. What is the GST benefit for Amazon?

The primary GST benefit for Amazon is the simplification of the tax structure. It eradicates the need for multiple state-level taxes, ensuring uniformity in the country’s tax system.

12. Does Amazon charge tax?

Amazon is required by law to collect taxes from customers in certain jurisdictions. This tax is then remitted to the government, streamlining the collection process.

13. Who is eligible for GST?

Any individual or business entity with an annual turnover surpassing the stipulated threshold is eligible for GST registration. Threshold values differ across states and business categories.

14. How much does a GST license cost?

The cost of obtaining a GST license varies based on the business type and operation state. For accurate registration fee details, consulting tax professionals or referring to the official GST portal is recommended.

15. How much does GST cost?

The GST rate varies depending on the type of product or service. There are multiple GST rates in India, including 0%, 5%, 12%, 18%, and 28%. The applicable rate depends on the category of the product or service being sold.